Investing in Precious Metals: Comparing the Price Trends of Gold and Silver

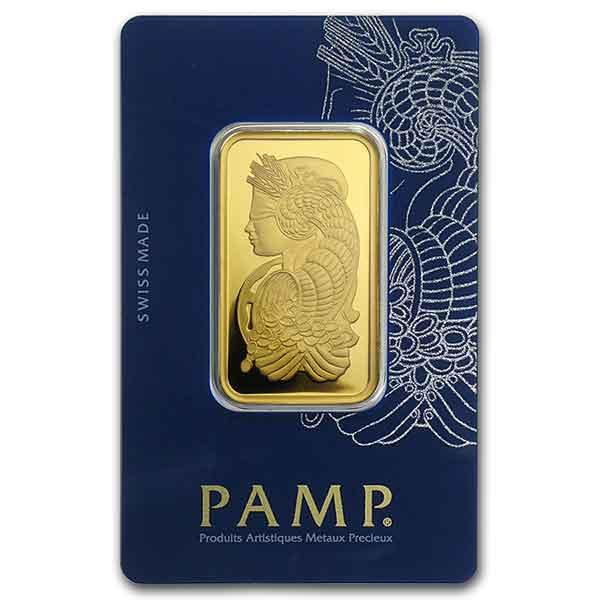

Consumers seek investments that offer stability, value maintenance, and diversity in a constantly developing economic world. Investors all over the world have always been captivated by gold and silver in particular. Precious metals have a high value due to their inherent worth and historical importance, making them stand out among the many alternatives available as timeless lakes of wealth.

The Precious Metals' Allure:

For years of age, precious metals have been associated with wealth, power, and status in human culture and trade. As the most valuable repository of prosperity, gold has been valued throughout civilizations due to its bright lustre and rarity. All of these metals work together to offer investors an insurance policy against inflation, depreciation of currency, and geopolitical unpredictability, which makes them vital components of diverse investment portfolios. Due to its adaptability and industrial uses, silver has been essential to both economic growth and related to technology improvement.

Comparing the Price Trends of Gold and Silver:

Dynamics of Supply:

There exist distinct differences in the supply dynamics of gold and silver.Gold and Silver Price volatility and imbalances in supply and demand can result from changes in base metal prices and mining production, which in turn affects the supply of silver. The production of silver is frequently fueled by by-products from base metal mining operations, whereas gold mining production is generally steady and predictable, supported by fresh discoveries and technological advances that foster long-term supply expansion.

Performance in the Past:

In periods of financial and economic turmoil in the past, gold has often performed better than silver. Though to some extent it is similarly regarded as a safe-haven asset, silver's price volatility is higher due to its greater reliance on industrial demand and market mood. Demand from investors looking for protection from market volatility has been fueled by its reputation as a safe-haven asset and store of wealth.

In summary:

Precious metal expenditures, particularly investments in gold and silver, empower investors with portfolio protection against volatile markets, wealth preservation, and diversity. Investors may make well-informed judgements and capitalise on opportunities in the precious metals market by contrasting the price patterns, market dynamics, and investment methods associated with gold and silver.