Currently, with the surge in cases of COVID-19, there is an increasing focus on personal hygiene and increasing production of medical nonwovens and single-use products, such as face masks and gloves. This, in turn, is expected to propel market growth in the next two years. On the other hand, concerns regarding the safety of reprocessed instruments are expected to limit market growth to some extent in the coming years. This, along with factors such as the high cost of endoscope reprocessing, limited reimbursement in developing countries, and end-user non-compliance with sterilization standards, may hamper the growth of the infection control market.

The increasing healthcare expenditure in North America and the increasing number of temporary hospitals are some of the major factors driving the demand and uptake of antiseptics and disinfectants in the region. Factors such as the increasing demand for hospital beds and ICUs in North America, proliferation of isolation facilities, and increasing awareness among consumers on hygiene and preventive healthcare have greatly boosted the demand for surface disinfectants. Furthermore, with the current COVID-19 pandemic wreaking havoc across the globe, various measures are being taken by companies as well as government bodies to drive market growth.

The plant had been shut due to harmful emissions, which were believed to be carcinogenic. In March 2020, the company received permission to reopen the plant for 21 days to sterilize PPE for healthcare workers to use during the COVID-19 pandemic. Such developments are anticipated to drive the growth of infection control market.

For More Info, Download PDF Brochure @ https://www.marketsandmarkets.com/pdfdownloadNew.asp?id=1084

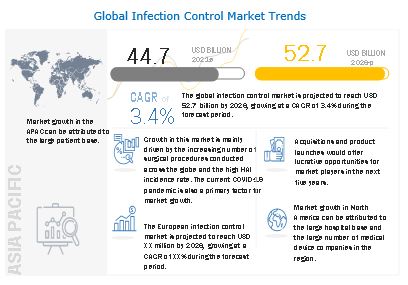

[550 Pages Report] The global infection control market is projected to reach USD 52.7 billion by 2026, at a CAGR of 3.4% during the forecast period. Growth in this market can largely be attributed to factors such as the increasing number of surgical procedures; the high incidence of hospital-acquired infections; the growing geriatric population and increasing incidence of chronic diseases; the growing focus on food sterilization and disinfection; technological advancements in sterilization equipment; and the increasing outsourcing of sterilization services among pharmaceutical companies, hospitals, and medical device manufacturers.

The usage of reprocessed equipment to disinfect or sterilize medical devices is higher than normal during the pandemic since improper decontamination of surgical instruments, endoscopic devices, respiratory care devices, and reusable hemodialysis machines can increase the chances of COVID-19. This has increased the demand for sterilization consumables to ensure the proper sterilization of medical devices.

Over the years, there has been a significant rise in the number of surgical procedures performed worldwide. According to the WHO (2019), approximately 235 million major surgical procedures are performed worldwide every year. This is attributed to the growing prevalence of obesity and other lifestyle diseases, the rising geriatric population, and the increasing incidence of spinal injuries and sports-related injuries.

The growing number of surgical procedures performed has resulted in the increasing demand for different surgical equipment and medical devices during these procedures. This is expected to drive the demand for infection control products and services due to the proven benefits of sterilized products and growing awareness about their effectiveness in infection control health settings.

Globally, the number of surgical procedures performed annually has increased significantly due to the rising geriatric population and the growing prevalence of obesity and diabetes. This has increased the demand for disposable medical products or single-use products that can be disposed of after use, reducing the chances of infection transmission.

The proper and effective sterilization of instruments, drapes, and supplies used in operating rooms, emergency treatment areas, and intensive care units significantly reduces the chance of infection. Single-use systems, such as tubing, capsule filters, single-use mixers, bioreactors, product-holding sterile bags, and other components are typically pre-sterilized, eliminating the need for sterilization before use. This has increased the demand for single-use medical devices, providing growth opportunities for market players offering sterilization products and services.

Currently, reprocessing of these instruments after every use is a major challenge faced by healthcare providers in complying with infection control standards. The Association for the Advancement of Medical Instrumentation has several working groups focusing on developing standards in several areas aimed to address the challenges involved in reprocessing medical devices.

The overall demand for infection control in hospitals is largely driven by the increasing prevalence of HAIs, the increasing number of hospitals and clinics worldwide, and the rising geriatric population (as this population segment is more susceptible to various chronic diseases). The growing volume of surgical procedures performed is also a major contributor to the growth of the market for hospitals. The rising number of government initiatives to ensure high degree infection prevention is also a significant driver of the market segment.

The prominent players in Infection Control Market are STERIS plc. (US), Getinge AB (Sweden), Cantel Medical Corporation (US), Advanced Sterilization Products (US), 3M Company (US), Belimed AG (Switzerland), MMM Group (Germany), MATACHANA GROUP (Spain), Sotera Health LLC (US), Ecolab, Inc. (US), Metrex Research Corporation (US), Reckitt Benckiser Group Plc. (UK), Miele Group (Germany), Melag (Germany), and Pal International (UK).